Difference Between Tariff and Non Tariff Barriers Explain With Examples

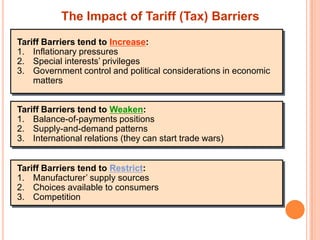

Tariff and non-tariff Tariff barriers can include a customs levy or tariff on goods entering a country and are imposed by a government. Quiz- Section 2 10 of 10.

Non Tariff Barriers Overview Origin And Types Examples

Trade barriers are imposed not only on imports but also on exports.

. The 15 is a price increase on the value of the automobile so a 10000 vehicle now costs 11500 to. Policymakers use these measures as a tool to regulate or encourage cross-border trade of goods. The trade barriers can be broadly divided into two broad groups.

Non-tariff barriers are trade barriers that restrict the import or export of goods through means other than tariffs. These increase product compliance costs. An example of an ad valorem tariff would be a 15 tariff levied by Japan on US.

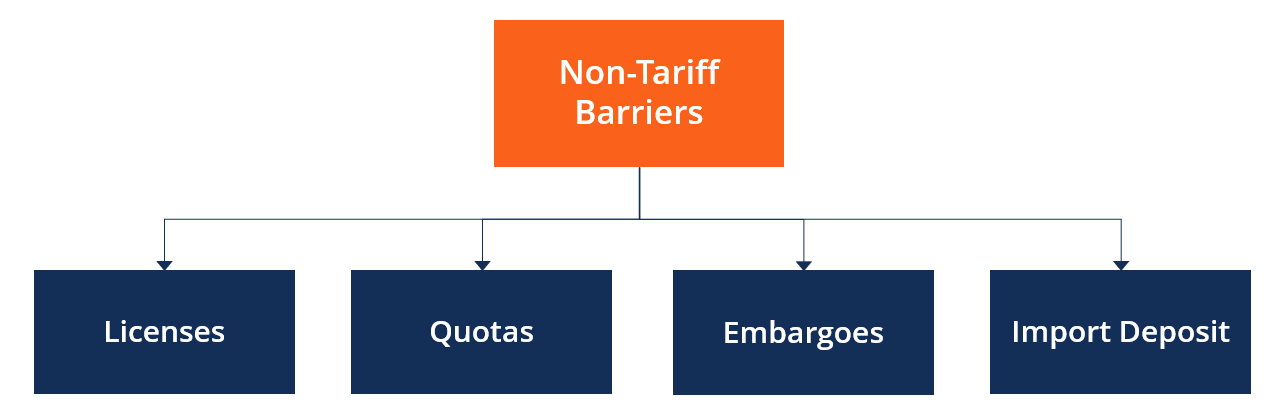

Second non-tariff barriers limit the functioning of the free market. The purpose of both tariff and non tariff barriers is same that is to impose restriction on import but they differ in approach and manner. Non Tariff Barriers These are non tax restrictions such as a government regulation and policies b government procedures which effect the overseas trade.

However it is favoured as an appropriate measure to meet the demand of the country and to protect the industry. Tariff barriers refer to duties and taxes imposed by the government on the goods imported from abroad. The trade barriers can be broadly divided into two broad groups.

The severity of tariff measures and non-tariff measures can make or break your international trade business. State trading enterprises are government monopolies 2 of 4 State trading enterprises are government monopolies. As against the tariff barriers non-tariff barriers are government policies and administrative.

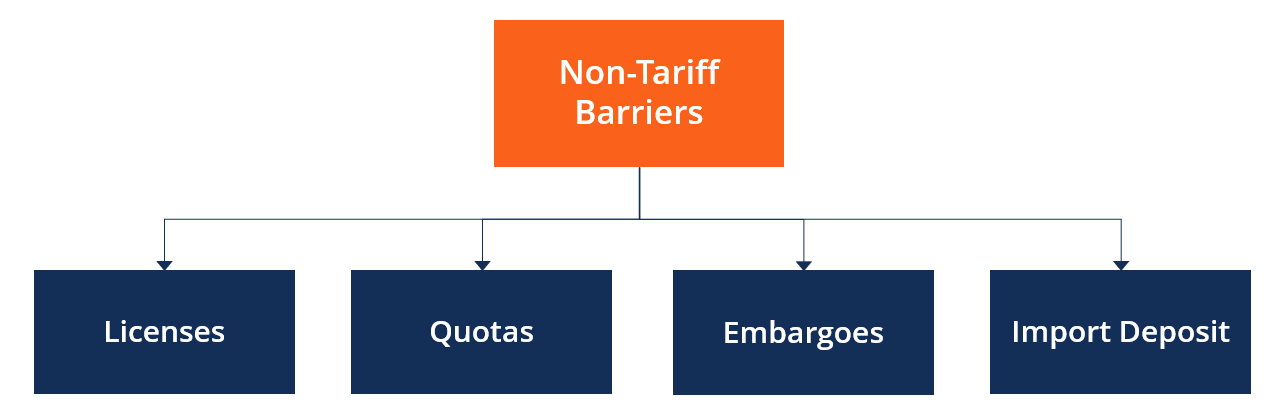

A Tariff Barriers and b Non-tariff Barriers. Import Licenses and Import quotas are some of. Two of the more common non-tariff barriers encountered are 1 of 4 Two of the more common non-tariff barriers encountered are.

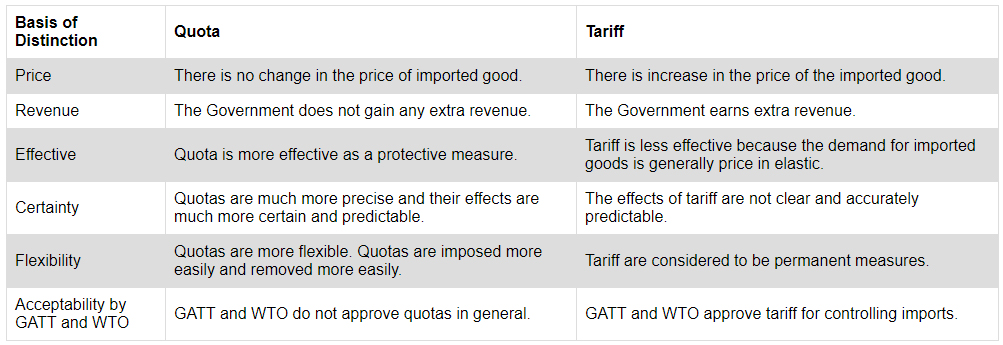

The quantity may be stated in. Under the tariff the government imposes a tax on imported goods. Non-tariff barriers can affect all forms of goods and services exports from food and manufactured products through to digital services.

Non-Tariff Barriers NTBs include all the rules regulations and bureaucratic delays that help in keeping foreign goods out of the domestic markets. Additionally what is an example of a non tariff barrier. Specific duty is based on the physical characteristics of goods.

Types of trade barriers. Then a series of non-tariff barriers to trade are examined including voluntary export restraints technical barriers to trade domestic content regulations import licensing the operations of import State Trading Enterprises STEs and. The World Trade Organization WTO identifies various non-tariff barriers to trade including import licensing pre-shipment inspections rules of origin custom delayers and other mechanisms that prevent or restrict trade.

Trade barriers are restrictions imposed on movement of goods between countries. On the other hand it does not apply to non-tariff barriers. Free market advocates view this as causing the inefficient allocation of resources in global markets.

TARIFF BARRIERS Tariff is a customs duty or a tax on products that move. Tariff is a customs duty or a tax on products that move across borders. The value of the product is not considered.

Baldwin 1 defined a non-tariff distortion as any measure public or private that causes internationally traded goods and services or resources devoted to the. A ten percent duty on imported goods. Tariff barriers ensure revenue for a government but non tariff barriers do not bring any revenue.

This is done to encourage domestic producers producing similar goods. Trade barriers are restrictions imposed on movement of goods between countries. Tariff or customs duty may be called a tax imposed by a government on physical goods as they move into or out of the country.

There is a quota. Technical barriers to trade including labeling rules and stringent sanitary standards. Both tariff barriers and non-tariff barriers are a form of international trade barrier.

The most important tariff barriers are - 1. Patents and copyright protection. It can be in form of quotas subsidies embargo etc.

The paper is organized as follows. A Tariff Barriers and b Non-tariff Barriers. Ad Valorem tariffs are the tariffs that keep imported items costly.

Intellectual property laws eg. You must first prove your product meet my standards. With the creation of the WTO and GATT it has become less difficult for countries.

Tariff barriers are not enough to protect domestic industries and this is why countries resort to non-tariff barriers that prevent foreign goods from coming inside the country. With tariffs the Government receives the revenue whereas no revenue is received by the Government by applying non-tariff measures. Tariff barriers examples include import duties specific duties and valor-em duties protective duties etc.

What are the tariff and non-tariff barriers for an international trade. When a fixed some of money keeping in view the weight or measurement of a commodity. The upcoming discussion will update you about the difference between tariff and non-tariff barriers.

Tariff barriers ensure revenue for a government but non tariff barriers do not bring any revenue. Import Licenses and Import quotas are some of the non tariff barriers. This kind of tax system is applicable for barrel of oil.

Your product is just plain illegal in my country. You need a permit. First tariffs import quotas and tariff rate quotas are discussed.

Difference between tariff and non-tariff barriers Barriers to international trade January 2 2020 April 10 2018 by Smirti Difference between tariff and non-tariff barriers. Trade barriers are imposed not only on imports but also on exports. Preferential state procurement policies where government favour local producers when finalizing contracts for state spending.

As tariff barriers and non-tariff barriers feature heavily in international trade and therefore. Quotas It is a numerical limit on the quantity of goods that can be imported or exported during a specified time period. Non tariff barriers are various quantitative and exchange control restrictions imposed in order to restrict imports.

Tariff barriers are levied either purely to collect revenue to meet the government expenditure or to protect domestic industries against foreign competition.

Distinguish Between Tariff And Non Tariff Barriers Owlgen

Non Tariff Barriers The Institute For Government

Pdf Tariffs And Non Tariff Measures Substitutes Or Complements A Cross Country Analysis

No comments for "Difference Between Tariff and Non Tariff Barriers Explain With Examples"

Post a Comment